Financial Freedom Starts Now: How the Next Generation Can Win with Money

“You have two choices: ACT NOW or pay later.”

That message might sound intense—but when it comes to money, it’s true.

Financial freedom isn’t about making six figures or hitting the lottery. It’s about understanding how money really works and making smart decisions early. Most young adults don’t realize the system isn’t set up to teach them what they actually need to know about money—and that gap in knowledge can cost hundreds of thousands of dollars over a lifetime.

At The Lantern Network, I lead monthly workshops to help students take back control of their financial future. Here are three key insights I wish every young adult learned today:

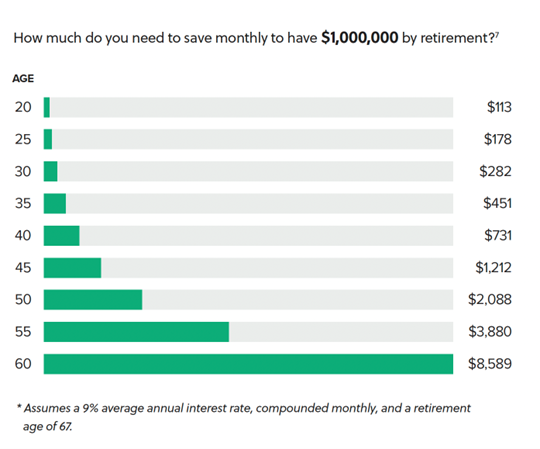

1. Time Is More Valuable Than Money

Thanks to compound interest, time is your greatest financial asset. If you start small in your 20s —even saving just $7 a day— you could become a millionaire by retirement age. Wait too long, and you lose that momentum. The earlier you start, the easier it gets.

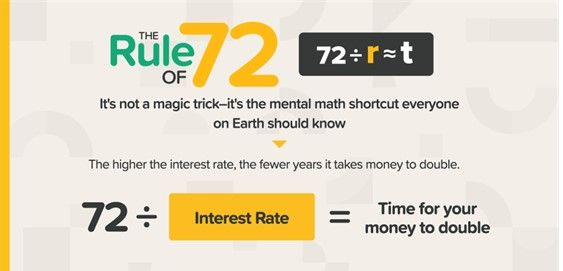

2. The Rule of 72: Learn It, Live It

Take the number 72 and divide it by your interest rate—that’s how long it takes your money to double. At 6%, your money doubles every 12 years. But at 0.15% (a typical savings account)? It’ll take 480 years! The lesson? Be intentional about where you put your hard-earned savings

3. Your First Investment Is YOU

Before investing in the stock market, invest in your financial education. Learn to budget, build an emergency fund, and avoid high-interest debt. Use tools like the 7 Money Milestones and the Financial Literacy Index as a roadmap. And don’t go it alone—work with a financial professional who can guide you, just like I do with our TLN mentees.

Final Word

You don’t need to be an economics major to understand how money works. As we celebrate Financial Literacy Month, let this be your wake-up call: Financial freedom is not a far-off dream—it’s a series of small, intentional steps you can start taking today. Start your journey today by downloading the “Change Your Literacy, Change Your Life” eBook and take control of your financial future.

Download your free eBook

Discover your financial literacy level

Ready to take action?

Schedule a one-on-one with me